The Great American Auto Squeeze: Navigating 2025’s Shifting Affordability Landscape

For over a decade, I’ve had my boots on the ground in the automotive industry, witnessing its seismic shifts from the global financial crisis to the electrification boom. What we’re currently experiencing in the U.S. auto market through late 2025 isn’t just another cyclical fluctuation; it’s a profound structural rebalancing, putting unprecedented pressure on consumer affordability. As we close out the third quarter and look towards the end of the year, the data tells a clear, if challenging, story: while sales figures have shown resilience, the dream of an accessible new or even a reliable used car is becoming increasingly elusive for many Americans.

The latest figures from Q3 2025 paint a picture of surprising consumer demand, with new-vehicle sales estimated to be up a healthy 4.5% year-over-year. This surge was fueled by a confluence of factors, not least of which was the scramble by many consumers to capitalize on federal EV tax credits before their September 30th expiration. Seasonal incentives around July 4th and Labor Day also played their part, drawing shoppers into showrooms. However, beneath this veneer of robust sales lies a troubling narrative of tightening inventory and escalating prices, particularly for the vehicles most Americans consider truly affordable.

Inventory Under Pressure: The New Normal?

Despite the uptick in sales, automakers have been cautious, even hesitant, to significantly ramp up inventory. We saw a 5% year-over-year drop in new vehicle inventory, pushing the average “days live” for a vehicle on a dealer lot down to just 70 days—a 12% contraction from Q1. This isn’t merely a post-pandemic supply chain hangover; it’s a deliberate, calculated strategy by manufacturers, exacerbated by burgeoning concerns over potential tariffs and a decline in specific imported models. While this lean inventory model can boost profitability per unit for automakers, it severely restricts consumer choice and negotiating power.

New vehicle prices have remained stubbornly high, hovering around the $49,000 mark with a modest 0.5% year-over-year bump. This figure has become an anchor point for the market over the past two years, effectively resetting the baseline for what a “new car” costs. From my vantage point, this plateau isn’t sustainable without a corresponding rise in median household income, which simply hasn’t kept pace. The implications for new car affordability are stark, forcing a significant portion of potential buyers out of the market or into longer, more expensive loan terms.

The Disappearing Act: Entry-Level Vehicles and the Tariff Tightrope

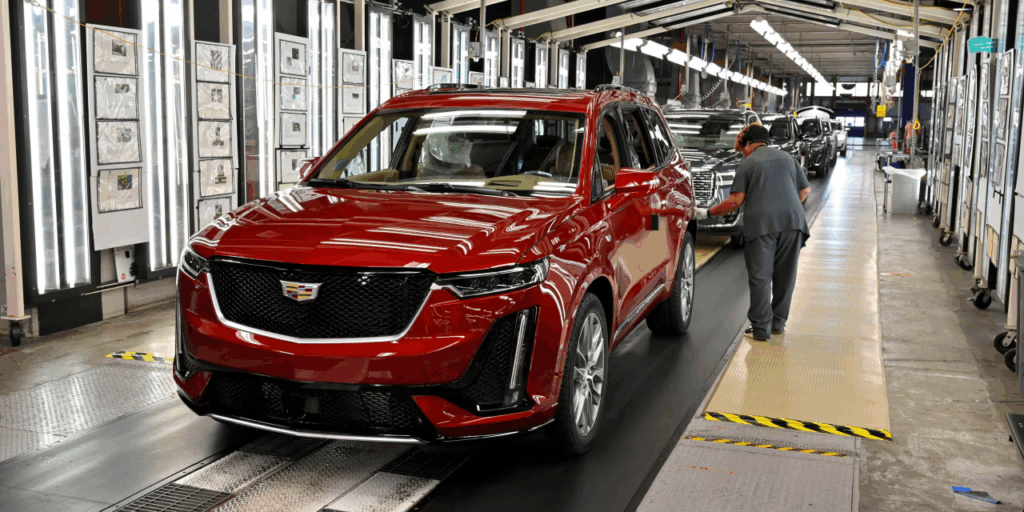

The most alarming trend for automotive market analysis and consumer access is the dramatic contraction of the sub-$30,000 new vehicle segment. Once the bedrock of accessible transportation, this category has dwindled to a paltry 18 offerings, with stalwarts like the Kia Soul teetering on the brink of departure. This isn’t just about rising manufacturing costs; it’s a strategic pivot by automakers towards higher-margin, more feature-rich trims. Why sell two $25,000 cars when you can sell one $50,000 luxury SUV for the same or better profit, especially when supply is constrained?

Adding another layer of complexity is the profound impact of tariff uncertainty. Historically, imported vehicles—often from Mexico or other lower-cost manufacturing hubs—have filled the void in the entry-level market, offering more competitive pricing due to reduced production overheads. However, increased tariff pressures are eroding this advantage, making even these budget-friendly imports more expensive. Crucially, only two U.S.-made cars (the Toyota Corolla and Honda Civic) currently start under $30,000, underscoring the severe lack of domestic options for cost-conscious buyers. This makes the low-end segment the fastest-shrinking part of the market, a concerning indicator for broader consumer vehicle access.

The mid-market sweet spot, vehicles priced between $30,000 and $49,000, is holding steady. This segment has become the default for many buyers who are either stretching their budgets or simply have no other options for a new vehicle. It’s here that the phenomenon of “trimflation” is most evident, with automakers prioritizing higher-spec configurations to maximize profitability. Meanwhile, the $50,000-$69,000 luxury segment saw inventory decline as shoppers, feeling the pinch, gravitated towards more “affordable” (though still premium) options in the mid-range. Unsurprisingly, the ultra-premium market for vehicles $70,000 and up continued its strong performance, driven by sustained demand for high-spec, large SUVs among affluent buyers who are largely immune to the broader affordability challenges. This dichotomous performance highlights the widening gap in car loan rates 2025 and purchasing power across different economic strata.

The Used Car Quandary: No Easy Escape

For those attempting to circumvent the escalating new car prices by opting for the used market, relief is increasingly hard to find. The third quarter of 2025 saw used car inventory shrink by 0.6% year-over-year, accompanied by a 2.8% increase in prices. More telling, perhaps, is the speed at which used vehicles are flying off lots: the average “days live” contracted from 55 days to a mere 50 days in Q1, marking the third consecutive quarter of accelerating sales. This phenomenon, which I’ve observed closely, indicates a market where urgency is paramount. Buyers are acutely aware that a good deal today might be gone tomorrow, or cost more.

The “sweet spot” of the used market—lightly used, low-mileage 1-3-year-old models—is particularly volatile. These vehicles, often still under manufacturer warranty and offering contemporary features, are highly sought after. The intensified competition for these vehicles allows dealers to command higher prices, further squeezing the budgets of those seeking best used car deals. Much like the new car market, the lower end of the used spectrum is experiencing its own crisis, with affordable options, especially those under three years old, becoming exceedingly scarce. This trend underscores the broader vehicle inventory crunch across both new and used sectors, affecting all buyer segments.

Electric Vehicles: Post-Credit Crossroads

The third quarter was an extraordinary period for Electric Vehicles (EVs), with demand soaring an impressive 28% year-over-year. This surge was undeniably driven by the looming September 30th expiration of federal tax credits, prompting a rush from consumers eager to lock in savings. Automakers, anticipating this demand, largely managed to keep EV inventory steady, down a mere 0.4% year-over-year. The market also saw an expansion of choice, with 76 EV models available compared to 61 in Q3 2024. However, this increased selection came with a price tag, as average EV prices rose by 2.6%, primarily due to the introduction of more expensive, higher-spec models.

Now, with the federal tax credits officially gone, the EV market stands at a crossroads. While some manufacturers have stepped up with their own incentive programs to soften the blow and maintain momentum, the long-term impact on affordable electric cars remains to be seen. My assessment suggests these manufacturer incentives, while helpful, are unlikely to fully offset the loss of federal subsidies, particularly for models that previously qualified for the full credit. Furthermore, with inventory shrinking and some production being curtailed as automakers reassess post-credit demand, these attractive deals are likely to be transient. For those still eyeing an EV, the window of opportunity for significant savings is rapidly closing. The future of EV tax credit expiration impact will be a key determinant of 2026 sales trends.

Navigating the 2025 Automotive Terrain: Expert Advice

So, what does this complex, tightening market mean for the average car shopper? From my ten years immersed in this industry, a few truths emerge:

Be Decisive, But Strategic: If you’re in the market for a new vehicle, particularly a 2025 model, don’t delay. While there might be some remaining incentives to clear out previous model years, the lean vehicle inventory crunch means these deals won’t last. For a 2026 model, be prepared for potentially higher prices but also a wider selection of the latest tech.

Broaden Your Search: For used cars, expand your geographical search radius. Utilize online platforms with robust filtering tools to scour a wider market. Be flexible with makes and models, prioritizing reliability and condition over brand loyalty.

Understand Total Cost of Ownership: With car loan rates 2025 still elevated, a seemingly good price can be overshadowed by high financing costs. Factor in insurance, maintenance, and fuel efficiency (or charging costs for EVs) into your budget.

Consider Certified Pre-Owned (CPO): While CPO vehicles often carry a premium over standard used cars, they come with extended warranties and rigorous inspections, offering peace of mind that can outweigh the initial higher cost, especially in a market where quality used vehicles are scarce.

Don’t Overextend: The temptation to stretch your budget to get “more car” is strong, especially with fewer affordable options. However, with economic uncertainties and persistent inflation, maintaining a healthy debt-to-income ratio is crucial. Avoid falling into a payment trap.

Expert Outlook: What’s Next for the U.S. Auto Market?

The third quarter of 2025, while strong in sales, might well be seen in hindsight as a period where significant demand was “pulled forward” from Q4 and early 2026. The urgency to buy before tax credits expired or prices rose due to tariffs created a buying frenzy that may not be sustainable. We anticipate a potentially softer fourth quarter, amplified by lingering low consumer confidence and the cessation of federal EV incentives.

The enduring challenge for automakers and consumers alike remains new car affordability. Unless there’s a significant shift in manufacturing strategies, a reduction in global trade tensions, or a substantial increase in consumer wages, the pressure on pricing will persist. The industry needs to innovate, not just in technology, but in delivering value and accessibility. The opportunity for an automaker who can genuinely figure out how to produce high-quality, inexpensive vehicles within the U.S., sidestepping tariff complications and import issues, is immense. This would be a true game-changer in the current landscape.

The road ahead is undoubtedly bumpy for many car shoppers. The era of abundant, affordable choices seems to be behind us for the foreseeable future. Staying informed, understanding market dynamics, and being strategic in your approach are no longer just recommendations; they are necessities.

Are you ready to navigate these complex market conditions? Explore our comprehensive resources and connect with our experts to make the most informed decision for your next vehicle purchase. Your ideal ride is still out there, but finding it requires insight and action.