Gracequeens Plus Size Cape Blazer Review: The Office Wardrobe Game-Changer!

Let’s be honest—finding chic, professional clothing in plus sizes can feel like an endless battle. I’ve faced this challenge for years, particularly with blazers. Tracking down one that fits perfectly, looks contemporary, and doesn’t break the bank seemed nearly impossible. Cape blazers appeared to be a fashionable option, but the sizing never quite worked for me.

I was searching for a women’s cape blazer that would actually complement my shape and be suitable for important meetings and presentations. I imagined a piece that was both comfortable and elegant. Was that really too much to hope for? I needed something to help me feel poised and empowered at work.

Truthfully, the hunt felt never-ending. I browsed countless sites, pored over reviews, and even tried on several blazers that were total letdowns. Issues ranged from overly tight sleeves and scrat

Gracequeens Plus Size Cape Blazer Review: The Office Wardrobe Game-Changer!

Let’s be honest—finding chic, professional clothing in plus sizes can feel like an endless battle. I’ve faced this challenge for years, particularly with blazers. Tracking down one that fits perfectly, looks contemporary, and doesn’t break the bank seemed nearly impossible. Cape blazers appeared to be a fashionable option, but the sizing never quite worked for me.

I was searching for a women’s cape blazer that would actually complement my shape and be suitable for important meetings and presentations. I imagined a piece that was both comfortable and elegant. Was that really too much to hope for? I needed something to help me feel poised and empowered at work.

Truthfully, the hunt felt never-ending. I browsed countless sites, pored over reviews, and even tried on several blazers that were total letdowns. Issues ranged from overly tight sleeves and scratchy fabric to unflattering cuts. I was on the verge of abandoning my quest for the perfect women’s cape blazer.

The Great Blazer Hunt

My search was quite thorough. I began by:

- Browsing major online retailers such as Amazon and ASOS.

- Exploring plus-size specialty stores like Torrid and Lane Bryant.

- Reading fashion blogs and articles focused on plus-size workwear.

- Asking friends and coworkers for their suggestions.

I even visited a few department stores, but the choices were limited and the prices were steep. I wanted something that offered good value for the money. Extremely low prices often signal poor quality, so I was willing to invest a bit more in a piece that would endure.

In the end, I realized how crucial it is to read detailed product descriptions and examine customer photos before making any online purchase. Don’t rely solely on the brand’s official images!

Verdict: Do your homework before shopping to steer clear of disappointment.

Eureka! Finding Gracequeens

Then, one day, while looking for a black blazer with gold buttons, I discovered Gracequeens. Initially, I was skeptical—I hadn’t heard of the brand before—but their blazers looked incredibly stylish and the prices were fair. I decided to take a leap and ordered the Ladies Blazers and Coats Plus Size Office Wear Work Long Sleeve Slim Small Suit Bodycon Blazer Jackets Women Coat Casual Female, available at black blazer with gold buttons. I truly hoped this would finally resolve my struggle to find the right women’s cape blazer!

Verdict: Sometimes giving a new brand a try really pays off!

My Gracequeens Experience

The Gracequeens blazer arrived promptly, and I was instantly impressed by the packaging. It felt more upscale than I had anticipated. The moment I tried it on, I could tell this was something special. The fit was incredible—it skimmed my curves perfectly without feeling constricting. The fabric was soft and comfortable, and the overall quality appeared excellent.

I wore it to a major work presentation and received numerous compliments. I felt confident and professional, certain this blazer would become a wardrobe staple for years. It was exactly the women’s cape blazer I had been dreaming of! I adore the design, the comfortable fit, and the overall aesthetic. Gracequeens truly hit the mark!

Verdict: This blazer is an absolute triumph!

Gracequeens: Pros & Cons

Here is my candid assessment of the advantages and drawbacks:

| Pros | Cons |

|---|---|

| Fashionable and flattering fit for plus sizes. | Sizing can be a bit inconsistent, so consult the size chart closely. |

| Comfortable, high-quality fabric. | Limited color selection. I wish there were more choices! |

| Professional, versatile design ideal for the workplace. | Shipping may take slightly longer than with some other retailers. |

| Affordable price for the quality offered. |

My Final Verdict

I am absolutely delighted with my Gracequeens blazer! It has completely transformed my work wardrobe, and I can’t imagine going without it. If you’re in the market for a stylish, comfortable, and reasonably priced plus-size blazer, I wholeheartedly recommend giving Gracequeens a look. This women’s cape blazer has been a lifesaver!

Verdict: I’m officially hooked! Go ahead and get yours now!

4 teen robbery suspects who escaped Sugar Land jail are back in custody, police say

Watch Eyewitness News and ABC13 originals around the clock

SUGAR LAND, Texas (KTRK) — Four aggravated robbery suspects who escaped the Sugar Land jail on Sunday afternoon are back in custody, the Sugar Land Police Department (SLPD) announced.

According to authorities, the suspects are 19-year-old Edmound Guillory, 18-year-old Devontae Simon, and 17-year-olds Desean Dillard and Clayton Johnson.

SLPD said the teenagers were involved in an aggravated robbery at a CVS at 1410 Crabb River Road, where they assaulted a store clerk and fled with a bag of cash just before 2 a.m. on Sunday.

Police said the suspects were first apprehended after a pursuit with Houston police officers, but managed to escape at approximately 4:50 a.m. when an SLPD jailer went to check on one of the teens.

Officials said when the jailer opened the cell, one of the suspects assaulted him and released the other prisoners.

The four suspects were located at the First Colony Church of Christ and taken back into custody at about 6:20 p.m., police said.

Authorities said the jailer was taken to a hospital, where he is stable.

All four suspects will be transported to the Fort Bend County Jail, where they will face additional charges ranging from escape to attempted murder, SLPD said.

Watch live breaking news coverage from ABC13 on our 24/7 streaming news channel.

Submit a tip or story idea to ABC13

Have a breaking news tip or an idea for a story you think we should cover? Send it to ABC13 using the form below. If you have a video or photo to send, terms of use apply. If you don’t, just hit ‘skip upload’ and send the details.

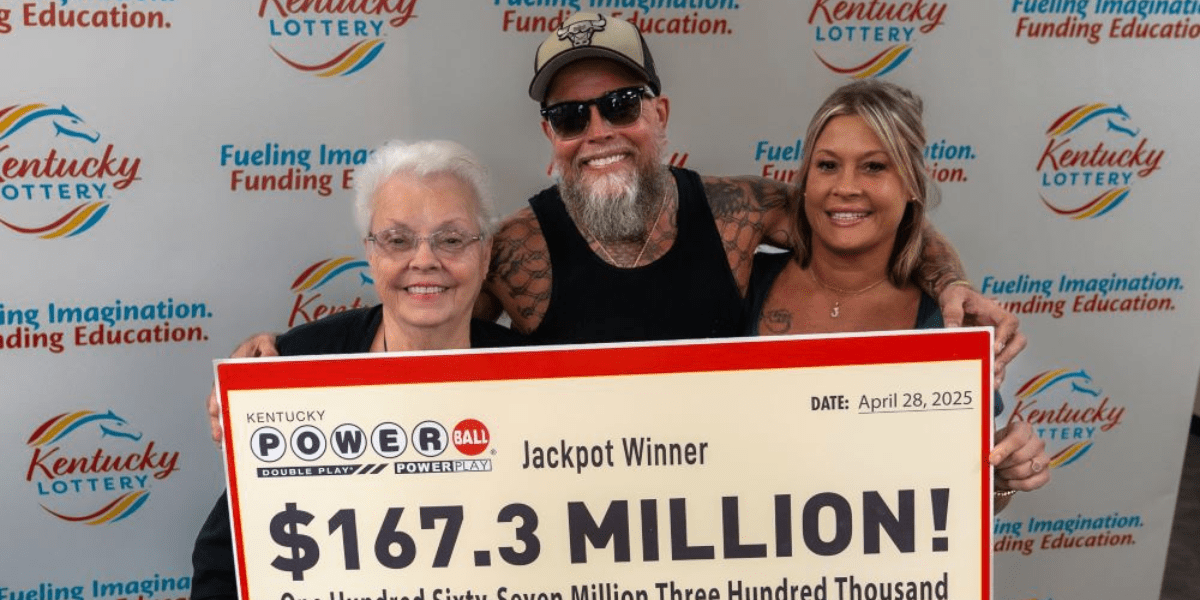

Winner of Kentucky’s biggest ever Powerball jackpot prize of $167 million lands in Florida jail just days later

A Kentucky Powerball winner was arrested and charged with kicking a police officer in Florida days after he won a $167 million jackpot.Kentucky Lottery

A Kentucky Powerball winner was arrested and charged with kicking a police officer in Florida days after he won a $167 million jackpot.

Join us at the Fortune Workplace Innovation Summit May 19–20, 2026, in Atlanta. The next era of workplace innovation is here—and the old playbook is being rewritten. At this exclusive, high-energy event, the world’s most innovative leaders will convene to explore how AI, humanity, and strategy converge to redefine, again, the future of work. Register now.

UAE: Transferring money to strangers could land you 10 years in prison

Depositing funds into unknown accounts can lead to serious legal consequence

Add as a preferred source on Google

Investigations revealed that many of these people had made deposits or transfers based on random requests from strangers.Shutterstock

At first glance, it may seem like a harmless scene: a group of people gathered around an ATM. One of them asks another for help depositing money into a bank account—either their own or an unknown recipient’s—claiming that their ATM card isn’t working or that they forgot their ID. The person agrees and uses their personal ID to make the deposit or transfer. While this might appear to be a simple act of kindness, the law views it quite differently.

In the UAE, depositing or transferring funds into unknown or unverified accounts can lead to serious legal consequences—particularly if the recipient’s account is later linked to organized crimes such as money laundering, terrorist financing, or drug trafficking.

Gulf News has tracked several such incidents and received reports of individuals being prevented from completing bank transfers due to suspicions surrounding the recipient accounts. Investigations revealed that many of these people had made deposits or transfers based on random requests from strangers, unaware of the legal dangers involved.

Legal advice

Speaking to Gulf News, lawyer and legal advisor Abeer Al Dahmani emphasized:

“First, it’s important to clarify that anyone who deposits or transfers money to strangers without prior knowledge or verification exposes themselves to legal liability—even if their intentions are good. Many individuals ask for help at ATMs claiming their cards are not working, but in reality, they may be attempting to carry out suspicious financial transactions. The law does not distinguish much between someone who was deceived and someone who was careless. While good intentions may reduce penalties, they do not absolve responsibility when negligence or willful ignorance is involved.”

Al Dahmani added, “Anyone making a transfer or deposit must verify the source of the funds and ensure they are legitimate. They must also know the identity and nature of the recipient and the purpose of the transaction. Transferring money to strangers—especially at ATMs under the pretense that they lack ID—is extremely risky. The person using their ID to complete such a transaction bears the responsibility, even if they don’t know the recipient. That money could be tied to drug trafficking, terrorist financing, or other serious crimes.”

SPONSORED LINKS BY PROJECT AGORA

Xuất Phát Nhanh Như Tuấn Mã – Thưởng Đến $5.000Aurra Markets

Phi Thẳng Thành Công – Khởi Đầu Thắng Lớn 2026Aurra Markets

Become Fluent in Any LanguageTalkpal – AI Language Learning

Penalty for money laundering

Al Dahmani explained: “The law is very clear. Article (2) of the Federal Law on Combating Money Laundering, Terrorism Financing, and Illegal Organizations states that any person who transfers, moves, or conducts any transaction involving funds, knowing they are proceeds of a crime, with the intent to conceal or disguise their source, is guilty of committing a money laundering offense.”

She added that Article (22) of the same law imposes strict penalties:

- Imprisonment of 1 to 10 years and a fine of no less than AED 100,000 and no more than AED 5 million, or both.

- “There is no room for leniency in such cases,” she said. “Ignorance of the law is not an excuse.”

Public prosecution issues a warning

The UAE Public Prosecution has also warned the public against this illegal behavior and falling into traps set by fraudsters and criminal gangs who exploit the trust and naivety of individuals to request money transfers to unidentified persons.

In its response to Gulf News, the Public Prosecution stated that using one’s personal ID to transfer money to someone else’s account may result in committing the crime of money laundering.

Transferring illicit funds or concealing their illegal source are both classified as acts of money laundering under UAE law.

To clarify, the Public Prosecution outlined the legal components of the crime:

- Money laundering offense: Never transfer money to someone you don’t know—you may be accused of laundering money. This crime essentially involves giving a legal appearance to funds obtained illegally by concealing or disguising their source through various methods of movement or transfer.

- Role of bank transfers: Bank transfers can serve as tools for laundering money, especially when used to conceal the origins of funds or mislead regulatory authorities.

- Legal risk: Individuals who transfer money to other people’s accounts, even unknowingly, may face legal consequences if the funds are later linked to illicit sources.

- Public prosecution’s advice: Exercise extreme caution when making any financial transfers. Always ensure the legitimacy of the money’s source to avoid any criminal suspicions.

- Additional guidance: If you’re unsure about the legality of the funds you’re about to transfer, it’s best to consult with your bank or relevant authorities before proceeding.

Penalties under cybercrime law

The UAE Public Prosecution, via its website and social media platforms, also clarified the penalties for transferring, possessing, using, or acquiring illicit funds through online networks.

Under Federal Decree Law No. 34 of 2021 on Combating Rumors and Cybercrimes, Article 30 stipulates the following:

Without prejudice to the provisions of the Anti-Money Laundering Law, any individual who deliberately uses an information network, electronic system, or any IT means to commit any of the following acts may be punished with:

- Imprisonment of up to 10 years

- A fine between AED 100,000 and AED 5,000,000, or both.

These acts include:

- Transferring, moving, or depositing illicit funds to conceal or disguise their illegal source.

- Hiding or disguising the truth about illicit funds, their source, movement, ownership, or related rights.

- Acquiring, possessing, or using illicit funds while knowing their unlawful origin.

Combating money laundering

According to UAE law, a person is considered guilty of money laundering if:

- They are aware the funds originate from a felony or misdemeanor;

- They intentionally transfer, move, or use such proceeds to conceal or disguise their illegal source;

- They hide or obscure the nature, location, manner of handling, movement, ownership, or rights related to the proceeds;

- Or they acquire, possess, or use the proceeds upon receipt, or assist the original perpetrator in escaping punishment.

The bottom line: Don’t transfer money for strangers. The risks—legal and financial—are simply too high.